Budgeting apps have come a long way. Some help you track your spending, others push you toward your goals. But over time, we realized something was missing: flexibility, simplicity, and a sense of ownership over how you manage your money.

We built Rewiser to be more than another expense tracker. Along the way, we spent time exploring what other apps do well and where they fall short. This list reflects that journey.

Below, you’ll find ten of the most popular budgeting apps of 2025. We’ve included nine widely used tools and our own platform, Rewiser, right at the top.

This is not about competition. It’s about helping you find what works best for you. Maybe that’s Rewiser, maybe it’s something else. If you’re looking for a budgeting app that adapts to your needs with plugins, AI, automation and a privacy-first design, you’ll understand why we built it.

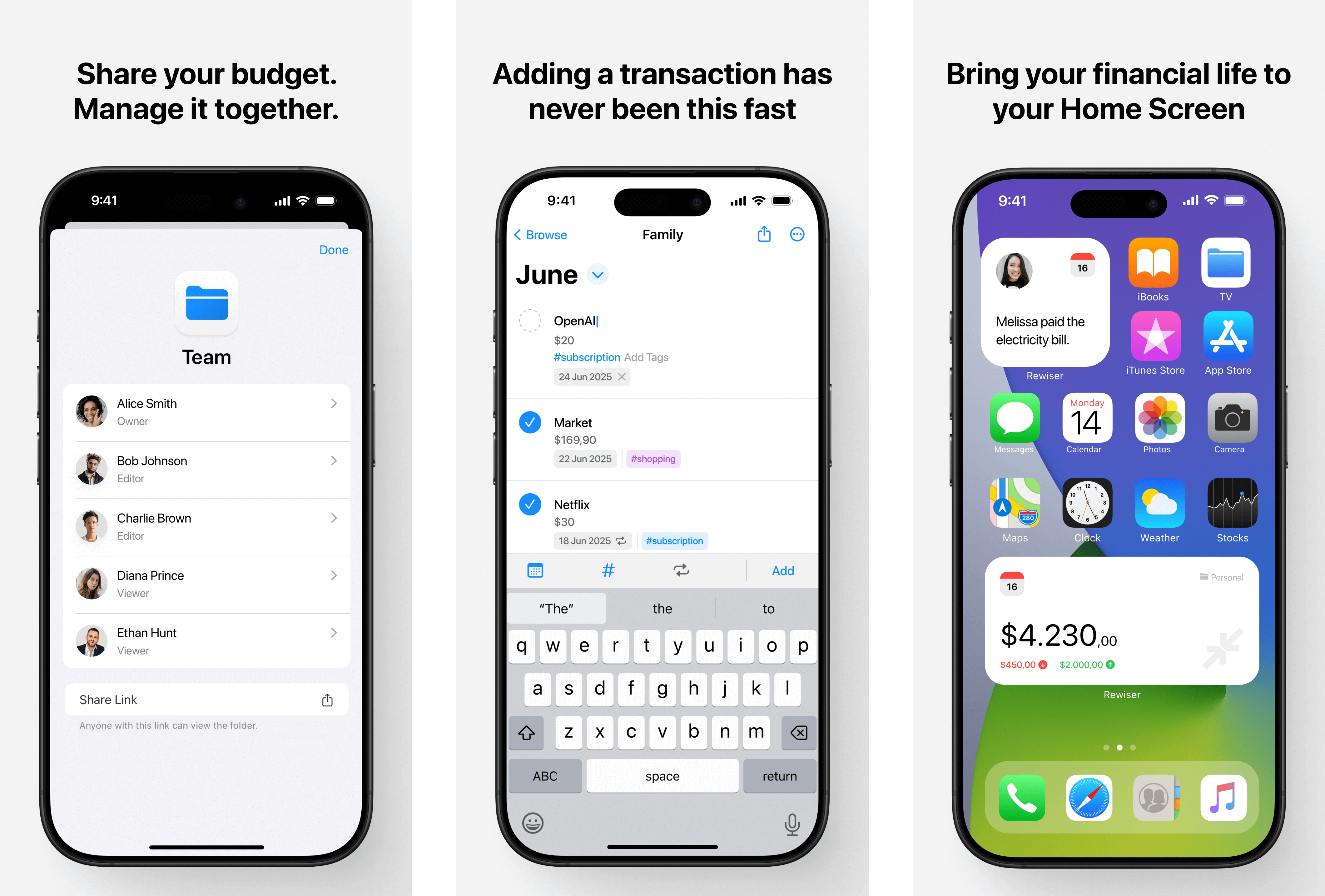

1. Rewiser

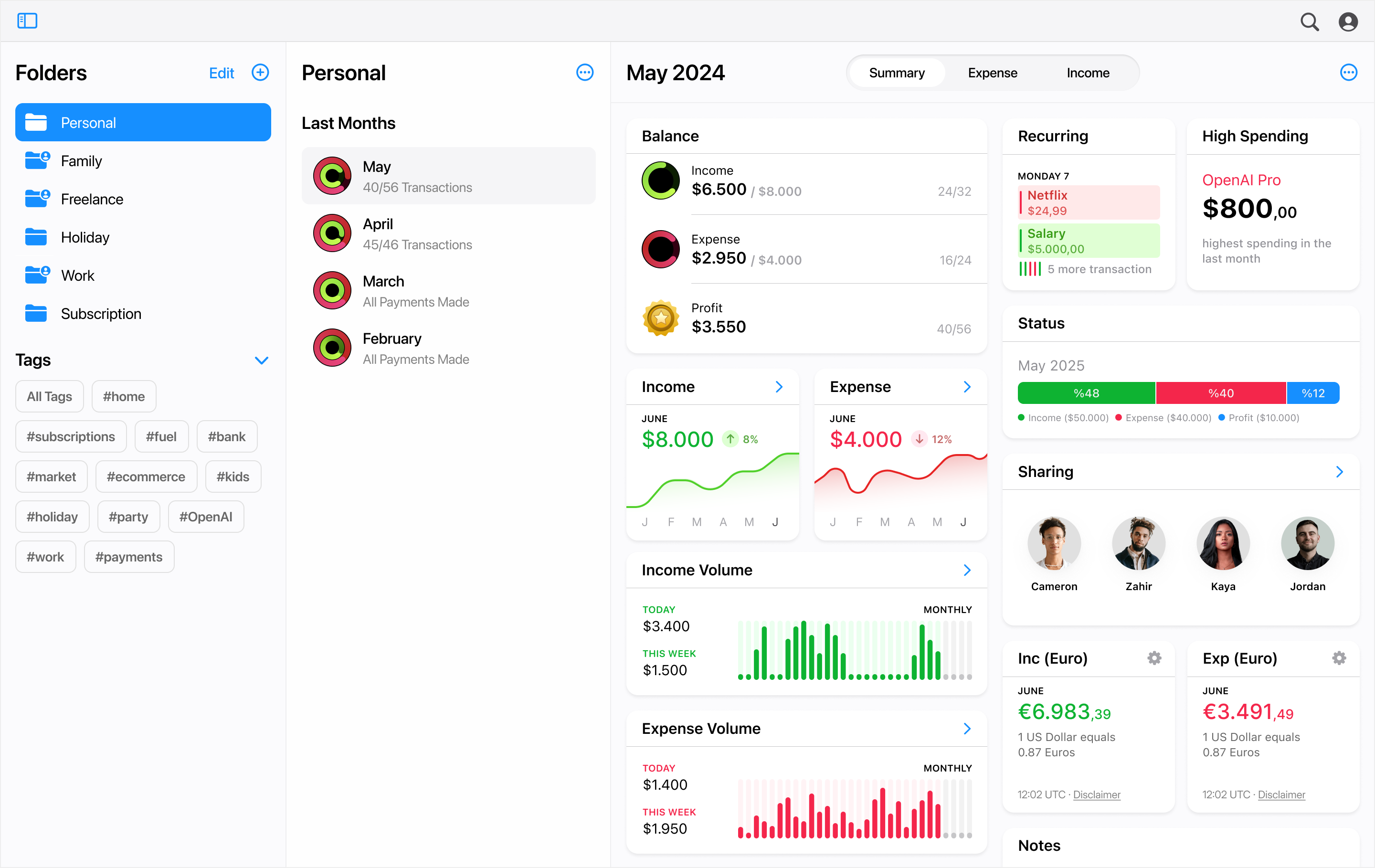

Rewiser is a modular, cross-platform budgeting app built for modern personal finance, where flexibility, automation, and privacy are no longer nice-to-haves but expectations. Unlike traditional budgeting tools that follow rigid templates, Rewiser adapts to how you work by letting you build your own system: every transaction lives inside a folder, and folders can be customized with extensions (plugins) to add new features like multi-currency support, AI tagging, hidden or encrypted folders, or Stripe income syncing.

Rewiser stands out with its plugin system, a unique approach that lets users activate only the features they need, whether that’s importing sales from Shopify, using AI to suggest transaction tags, or locking sensitive folders behind a password. For users who want to go beyond “set a budget and track expenses,” Rewiser becomes a financial operating system that can scale with you over time.

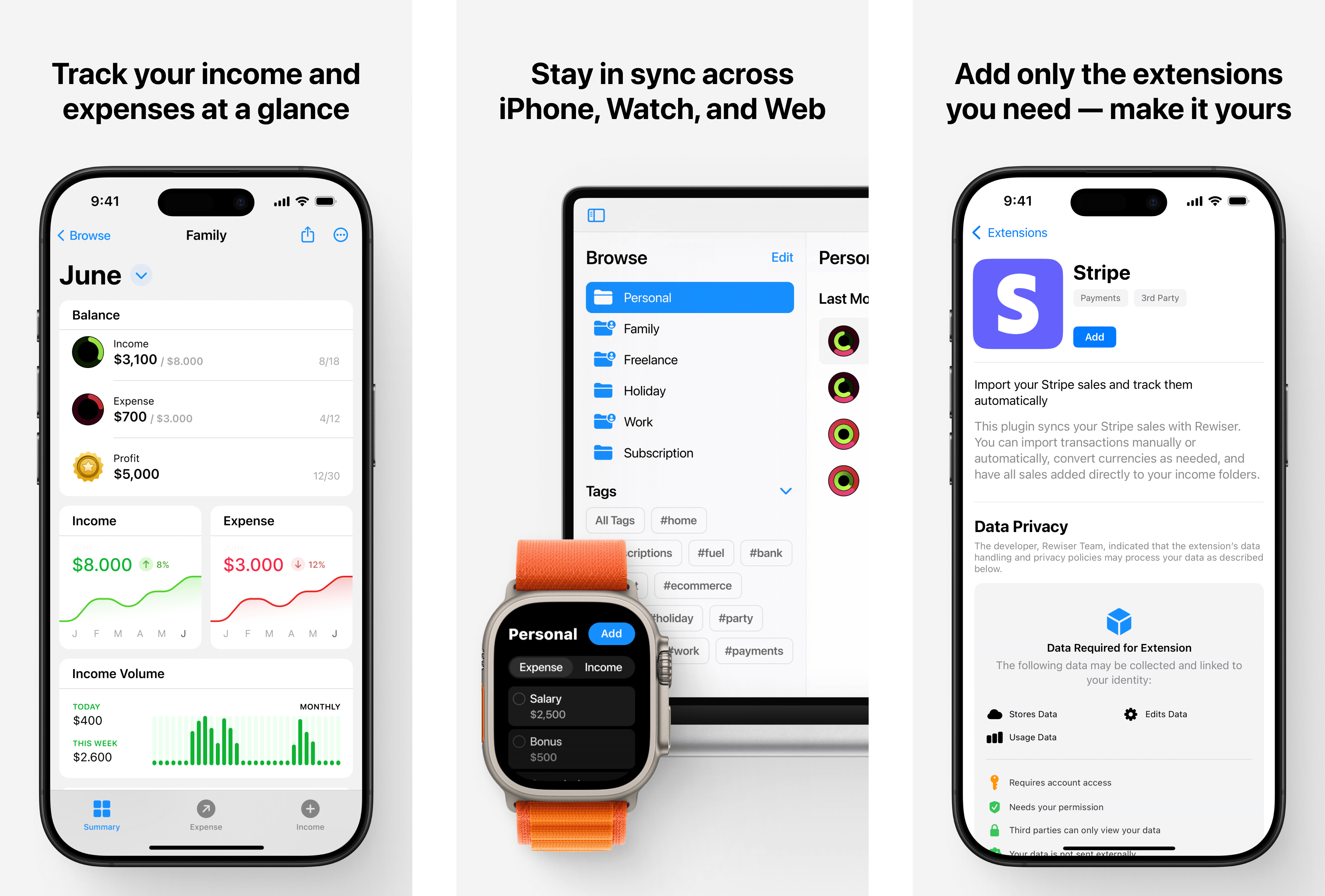

With support for iOS, Apple Watch, and Web, Rewiser maintains a consistent design language inspired by Apple’s native apps like Notes, Reminders, and Files, prioritizing clarity and minimalism. That means no confusing dashboards or steep learning curves. Every screen looks familiar yet highly purposeful.

The app also integrates AI carefully, with user privacy at the forefront. AI never sees or stores your personal identity and is only triggered locally or via server functions that are not linked to your account. Features like AI-powered tag suggestions, natural language voice input via Apple Watch, and prompt-driven report generation give Rewiser a futuristic edge without compromising user trust.

Rewiser’s focus on modularity, privacy, and cross-device design makes it ideal for users who want a clean interface, smart automation, and the ability to grow or simplify their finance system as they go.

Key Features

Plugin-Based Customization

Rewiser introduces a plugin system that lets users shape the app around their needs. Need multi-currency support? Enable it. Want AI-powered tag suggestions? Add the AI Tags extension. Prefer to keep some folders private? Activate the lock or encryption plugins. Every folder can be customized independently, turning Rewiser into a flexible, modular finance platform.

AI Tagging and Report Generation

With Rewiser AI, users can automatically receive tag suggestions based on the description of each transaction. These suggestions are generated in real time without linking to your profile. In addition, users can create custom financial reports simply by writing a prompt. The AI doesn’t access your data. It only creates the logic. Your financial details remain secure.

Natural Voice Input via Apple Watch

Rewiser’s Apple Watch app allows for fast transaction entry using natural speech. You can say, "I spent 20 dollars on lunch today," and Rewiser will parse the input and create the transaction accordingly. Voice input is processed in a way that maintains complete privacy, converting speech to text locally before using AI for interpretation.

Built-In Privacy by Design

Unlike some platforms that offer AI at the cost of privacy, Rewiser separates logic from identity. All AI processing is abstracted from personal data, and users can choose to disable any AI-powered feature at any time. No prompts or voice inputs are stored or tracked, and Rewiser never sells or shares data with third parties.

Cross-Platform Consistency

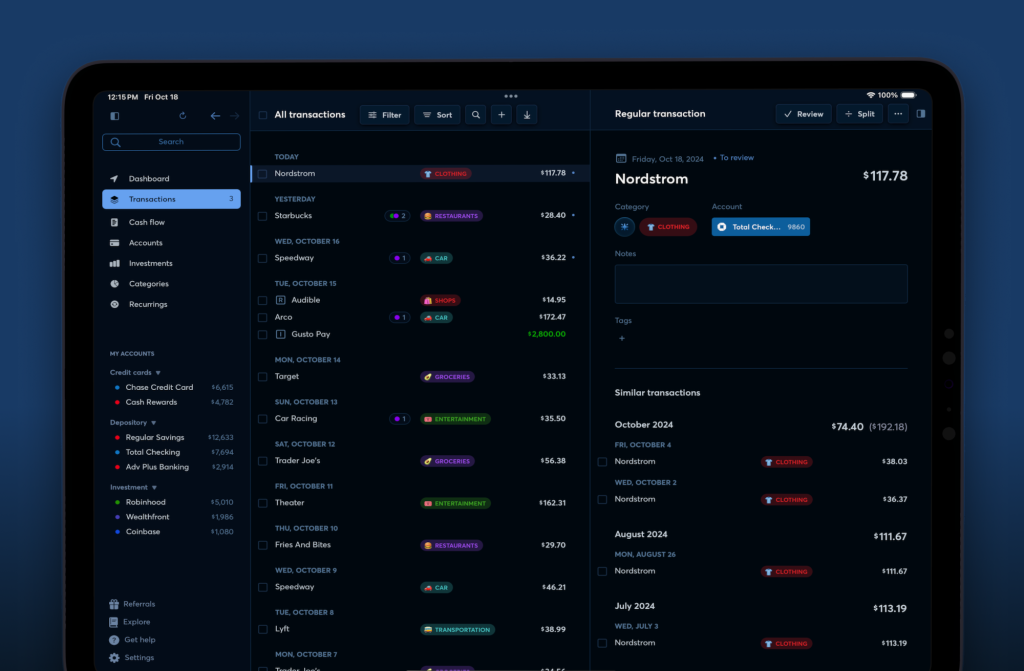

Rewiser offers a unified experience across iOS, Apple Watch, and Web. Inspired by Apple’s design principles, the interface is clear, gesture-friendly, and instantly familiar to anyone who has used Notes, Reminders, or Files. With features like Split View on Web, Rewiser removes the need for constant screen switching and presents all information in one seamless flow.

Zapier Integration

Rewiser is an official Zapier partner. You can connect external tools like Google Sheets, PayPal, Slack, Notion, and Airtable to automate your workflows. With prebuilt Zap templates, even non-technical users can start syncing data into Rewiser in minutes. Use automation to push in sales, manage shared budgets, or even generate transactions from form submissions or CRM platforms.

Shared Folders and Permissions

Every folder in Rewiser can be shared with others. Whether you’re managing a household budget with a partner or collaborating with a small team, shared folders include permission control, giving you full visibility over who can view or edit the data.

Multi-Currency Folder Support

Each folder can have its own currency, making Rewiser a great fit for freelancers, digital nomads or international teams. This design removes the need for complicated currency conversion settings across the app. Every folder is self-contained and logically independent.

Pricing

Rewiser offers a generous and transparent pricing structure with options for individuals, power users, and teams.

Hobby (Free Forever)

Rewiser’s free plan is more than a trial. It’s a fully usable tier that gives new users a strong foundation for managing their finances. It includes:

Unlimited transactions

Folder sharing with friends or partners

1-year data backup

This makes it a perfect choice for students, solo users or anyone just starting out with budgeting. You can track spending, share budgets and never worry about data loss without paying a cent.

Pro – $9.90/month or $89.90/year

The Pro plan unlocks the full Rewiser experience. Designed for users who want to take full control over their financial system, it includes:

All features in the Hobby plan

Unlimited folders (ideal for managing multiple budgets, currencies, or projects)

Access to all extensions (like AI Tags, Stripe sync, encrypted folders)

Unlimited data backup

Email support

The yearly subscription brings the monthly cost down to $7.49, making it competitively priced for the amount of flexibility and extensibility it offers.

Enterprise – Custom Pricing

For teams, startups, and businesses that need tailored functionality, Rewiser offers a custom Enterprise plan. It includes everything in Pro, plus:

Custom extension solutions

Bulk upload and data migration support

Advanced support and dedicated onboarding

This option is ideal for finance teams, remote collectives, or businesses looking to integrate Rewiser into internal workflows and systems. Enterprise customers can discuss needs directly through a dedicated contact channel.

Pros & Cons

Pros

✓ Modular and customizable experience

Rewiser’s plugin system lets you tailor the app to your exact needs. From AI automation to multi-currency folders and secure data privacy, it grows with you.

✓ True free plan with meaningful features

Unlike many apps that offer limited trials, Rewiser’s free tier includes unlimited transactions and folder sharing. It’s a usable product, not a teaser.

✓ AI-powered features with privacy at the core

Rewiser AI never sees or stores your identity. From tag suggestions to report logic generation, everything is built around user-first privacy standards.

✓ Clean, familiar UI inspired by Apple design

Users feel at home instantly thanks to an interface shaped by native Apple app patterns (Notes, Files, Reminders). This improves onboarding and reduces friction.

✓ Real-time collaboration with shared folders

Users can share folders with partners or teams and manage finances together. This is a core feature available even in the free plan.

✓ Zapier integration for external automations

Connect Rewiser to over 6,000 apps through Zapier. Push transactions from platforms like Google Ads, Notion, PayPal, Airtable, or Slack without code.

✓ Cross-platform access (iOS, Web, Watch)

Track, tag and analyze your finances wherever you are. Includes voice input on Apple Watch and split-screen views on the web app.

Cons

✗ No Android support (yet)

Rewiser is currently available only on iOS, Web, and Apple Watch. Android support is on the roadmap but not yet released.

✗ Lacks a desktop-native app

Although the web experience is fast and responsive (especially with Split View), some users may prefer a native Mac or Windows app.

✗ AI usage requires an internet connection

AI-powered features like tag suggestions and report building rely on cloud functions. Offline use is fully possible, but without AI enhancements.

Platforms & Extensibility

Available Platforms

Rewiser is available on the following platforms:

iOS (iPhone)

Apple Watch with voice input support

Web with full functionality and Split View experience

Each version is built to deliver a consistent experience. You can review your budget in detail on desktop, quickly log expenses on your phone, or speak to your watch to add a transaction while on the move. All platforms are seamlessly synced, so your data is always up to date.

Consistent User Experience

All Rewiser interfaces follow Apple’s Human Interface Guidelines. This ensures a familiar and intuitive interaction flow for anyone who has used built-in apps like Notes, Files, or Health. The web version introduces a Split View layout that mirrors native behavior and reduces screen switching. This helps users stay focused on their tasks without needing to learn something new.

Modular Features with Extensions

One of Rewiser’s strongest features is its plugin system. Instead of cluttering the core app, advanced tools are delivered through optional extensions. Users can enable only what they need, shaping a personalized financial system. Available extensions include:

Multi-currency folders

Locked or encrypted folders

AI-powered tag suggestions

Stripe and PayPal integrations

Shared folder access

Automatic backup and export tools

Custom fields for transactions

And more

All plugins are no-code, updated regularly, and can be turned on or off anytime.

Zapier Integration

Rewiser is an official Zapier partner, allowing you to connect with over 6,000 apps. With our ready-made templates, you can create workflows like:

Add a new transaction when a Google Sheets row is added

Sync PayPal income into a specific folder

Turn a Notion database entry into a Rewiser transaction

Post a message to Slack when a new expense is logged

Pull store data from Shopify or Webflow Commerce

This makes Rewiser a central hub for financial data, collecting inputs from various platforms into one cohesive interface.

API for Developers (Coming Soon)

Rewiser is working on a suite of developer tools that will include:

AI-powered endpoints for data cleaning and transformation

Webhooks for folder and transaction updates

A custom extension SDK for enterprise-grade solutions

These tools will help developers connect Rewiser to internal systems, build automated workflows, and manage data with precision. All endpoints will follow strict privacy and security standards.

Final Verdict

Rewiser is not just another budgeting app. It is a platform built with intent, designed for people who want both control and simplicity in their financial lives. While many apps offer a one-size-fits-all solution, Rewiser does the opposite. It provides structure without forcing limitations, and guidance without taking over.

Its plugin system sets it apart. You do not need to adapt your financial habits to the app. Instead, the app adapts to you. Whether you are looking for AI-powered features, secure folder encryption, shared budgeting with your partner, or integrations with tools like Zapier, Rewiser delivers them in a clean and purposeful way.

For those who value user experience, Rewiser feels immediately familiar. If you have ever used Notes, Reminders, or Files on your Apple devices, you will feel at home. There is no need to read lengthy guides or explore hidden menus. Every screen is designed with clarity and speed in mind.

And perhaps most importantly, Rewiser respects your privacy. The app ensures that your financial data is never used to train AI, sold to third parties, or shared without your permission. You remain in control, always.

Whether you are budgeting alone, with a partner, or as a small team, Rewiser gives you the tools to organize, automate, and scale your financial workflow. It is built for now, but designed to grow with you.

If you are looking for a budgeting app that combines elegance, power, and flexibility, Rewiser deserves your attention.

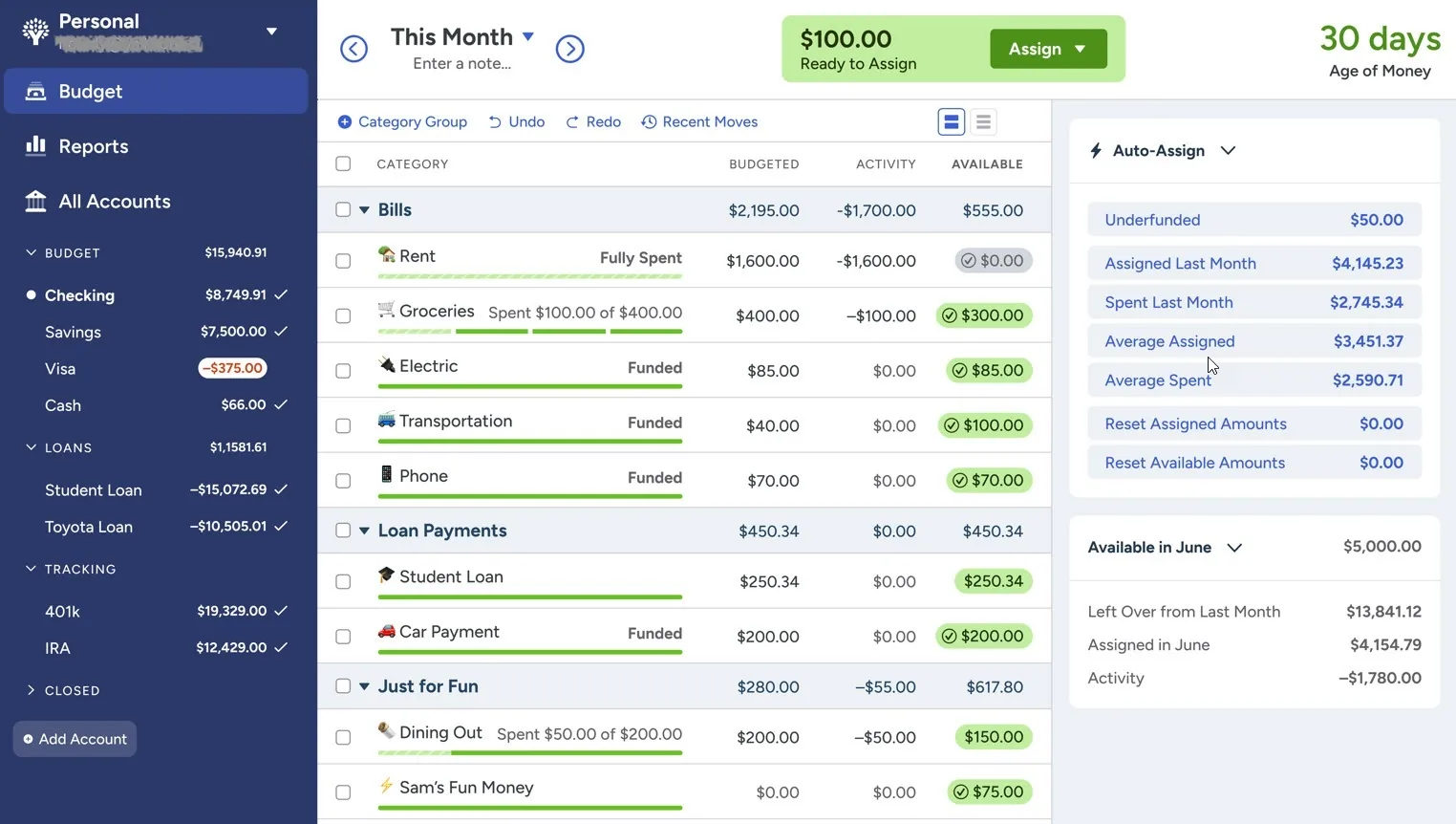

2. YNAB (You Need A Budget)

Overview:

YNAB is a popular zero-based budgeting app designed to give every dollar a job and help users take full control of their finances. It’s known for its proactive, hands-on approach. Users assign income to spending categories and make adjustments throughout the month. YNAB focuses on building strong budgeting habits and offers extensive educational resources, including live workshops, guides and an active community. This makes it a great choice for detail-oriented users who want to be fully involved in managing their money. It has a loyal user base and claims new users save an average of $600 in their first two months.

Key Features:

Zero-Based Budgeting:

YNAB follows a strict zero-based method. Every dollar is assigned to a specific category such as expenses, savings or debt. The app teaches four guiding rules including giving every dollar a job, planning for true expenses, rolling with overspending and aging your money.

Real-Time Sync Across Devices:

YNAB supports web, desktop, iPhone, iPad, Android, Apple Watch and even Alexa. All your data syncs instantly, so you can check your budget or add transactions from anywhere. You can even ask Alexa how much is left in a category.

Bank Account Import:

YNAB connects with banks and credit cards through aggregators like Plaid. It supports many institutions in the US, Canada, UK and parts of the EU. For unsupported banks, you can import files or enter transactions manually.

Budget Sharing (YNAB Together):

One subscription includes up to six household members. Each person gets their own login, making it easy to share a budget with a partner or roommate.

Integrations and API:

YNAB offers an open API that lets tech-savvy users and third-party apps connect to it. You can extend the app with Alexa skills, custom automations or integrations like voice input and analytics. While there’s no official plugin store, the API and community offer solid flexibility.

Pricing:

YNAB is a subscription-only app. It includes a 34-day free trial for new users. After that, it costs $14.99 per month or $109 per year (around $9.08 per month when billed annually). Students may qualify for a free 12-month plan. While the price is on the higher end, YNAB notes that most users save more than the cost by using the app effectively. One subscription can be shared with up to five others in your household.

Pros:

Effective zero-based budgeting method that leads to intentional spending and higher savings

Cross-platform support including web, desktop, mobile, Apple Watch and Alexa

Highly customizable with flexible categories, goals and reporting

Strong learning resources and community support

Proven results with many users saving hundreds or thousands within the first year

Cons:

Steeper learning curve and time investment required

No free plan beyond the trial period

Limited international bank support and no multi-currency budgeting

No built-in AI suggestions or coaching

Requires consistent manual updates to stay useful

Platforms:

YNAB runs on web, iOS, Android, iPad, Apple Watch and Alexa. All platforms sync seamlessly through the cloud. The desktop web app is great for detailed budgeting, while the mobile apps make it easy to enter transactions on the go.

AI and Extensibility:

AI features: None. YNAB focuses on manual review and adjustment.

Extensibility: With its open API, YNAB can be connected to other tools or customized with scripts. There is no official plugin marketplace, but third-party options exist through the community.

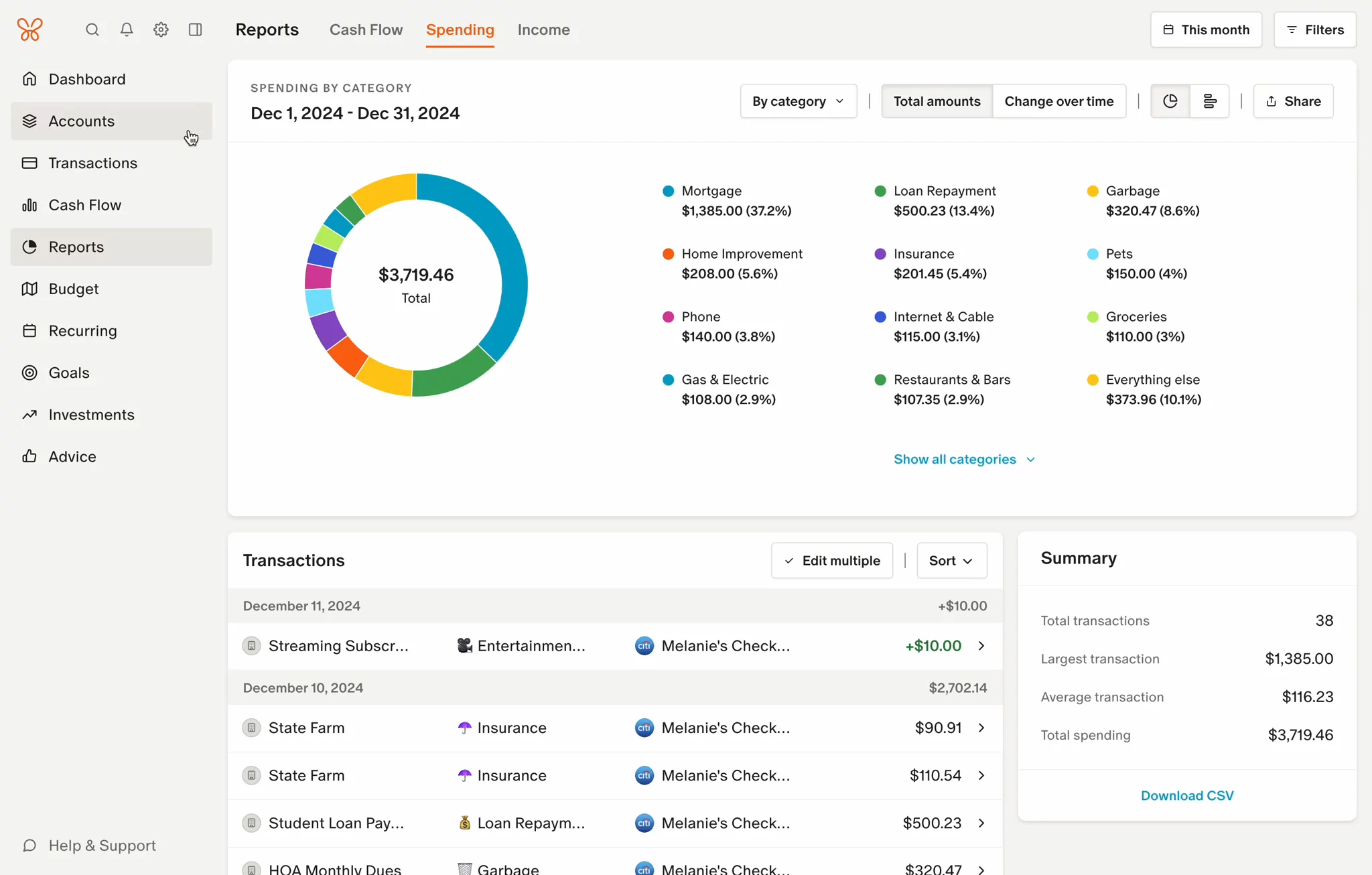

3. Monarch Money

Overview:

Monarch Money is a modern personal finance app that blends budgeting with full-spectrum wealth tracking. Designed as a next-generation alternative to Mint, Monarch helps users manage day-to-day expenses while also keeping an eye on long-term goals and overall net worth. One of its standout features is collaboration. You can securely share your financial data with a partner or even a financial advisor. This makes it a great fit for individuals, couples or households looking for an all-in-one view of their money.

Key Features:

Unified Financial Dashboard:

Monarch connects to thousands of banks and financial institutions to automatically sync your accounts. You can view checking, savings, loans, credit cards, and investment balances all in one place. Everything updates in real time, so you always have an accurate view of your finances.

Custom Budgeting and Alerts:

You can create flexible budgets based on monthly or custom timeframes. Categories are fully customizable and can include recurring, irregular or one-time expenses. Monarch notifies you about upcoming bills and alerts you if you’re close to exceeding your budget. It’s a system that adapts to your planning style rather than forcing a rigid structure.

Investment and Net Worth Tracking:

Unlike most budgeting-only apps, Monarch also tracks investment accounts, retirement plans and calculates your net worth over time. Portfolios are aggregated so you can monitor asset allocation, growth and performance directly within the app.

Collaboration with Partners or Advisors:

Monarch lets you invite other users to your account. Couples can co-manage finances with separate logins, and you can also give access to a financial advisor. Advisors get a secure view of your financial situation without seeing sensitive data like account numbers. This feature is rare and ideal for people working with professional planners.

Privacy and No Ads:

Monarch is a subscription-based app and does not display ads or promote products. It uses bank-grade encryption and two-factor authentication to protect your data. Your financial information is not sold. Monarch’s business model is built entirely around subscriptions, not advertising.

Pricing:

Monarch offers a 7-day free trial. After that, it costs $14.99 per month or $99.99 per year, which works out to about $8.33 per month when billed annually. This places Monarch in the premium tier, similar to YNAB. While it may be more expensive than basic apps, you’re paying for an ad-free experience, strong security and a broad feature set. New users are often offered annual discounts during the trial.

Pros:

Combines budgeting, bill tracking and investment tracking in one place

Offers a clean and modern interface with clear charts and detailed insights

No limits on the number of accounts or collaborators

Fully customizable budgets and categories that adapt to your planning style

Ad-free experience with strong privacy practices and secure data encryption

Cons:

No free version beyond the 7-day trial

Ongoing cost may be high for users on a tight budget

Primarily supports US and Canadian accounts and only handles USD

No built-in AI insights or bill negotiation features

Does not offer a public API or plugin support, which limits extensibility

Platforms:

Monarch is available on iOS, Android and any desktop browser. The web app is fully featured and great for detailed financial planning. Mobile apps are smooth and fast for everyday use. Data syncs instantly across devices, so everything stays consistent no matter where you make updates.

AI and Extensibility:

AI features: None. All budgeting and insights are created manually by the user.

Extensibility: Monarch does not currently offer an open API or plugin system. It is a closed platform, meaning you can’t connect it to other tools or build custom modules. However, its native features cover most personal finance needs.

4. Spendee

Overview:

Spendee is a colorful and intuitive budgeting app built for simplicity and group collaboration. Based in Europe, it offers both manual and semi-automated tools for tracking spending. One of its standout features is shared wallets, which let multiple users manage a budget together. Spendee also supports nearly 200 currencies and cryptocurrencies, making it a great fit for travelers, international users and anyone with diverse financial accounts. With a friendly interface and flexible pricing, it’s especially appealing to beginners or casual budgeters looking for a stress-free way to organize their finances.

Key Features:

Shared Wallets for Group Use:

Spendee allows you to create wallets that can be shared with other users. This is perfect for couples, families or roommates who want to manage joint expenses like rent, groceries or vacations. Each person can view, add or edit transactions in real time with proper permission controls.

Multi-Currency and Crypto Support:

Spendee handles multiple currencies with ease. You can manage different wallets in different currencies and the app provides live exchange rates. It also supports crypto tracking, allowing you to view balances for major cryptocurrencies alongside your regular budget.

Bank Sync and Auto Categorization (Premium):

Premium users can connect their bank accounts and credit cards to automatically import transactions. Spendee includes an advanced auto-categorization system that learns from past behavior, making transaction tracking faster and more accurate over time.

Budgets and Bill Reminders:

You can set monthly budgets for any category, like groceries or transport. Spendee shows visual progress and alerts you when you're close to your limits. You can also mark transactions as recurring or set up bill reminders so you never miss a payment.

Cloud Backup and Data Export:

All data is securely stored in the cloud, and you can export your transactions to CSV or Excel at any time. Spendee offers attractive visuals including pie charts and bar graphs, plus a detailed overview screen for more in-depth analysis.

Pricing:

Spendee uses a three-tier model:

Basic (Free): Includes core budgeting features but limited to one wallet and one budget. No bank sync.

Spendee Plus: Around $1.99 per month or $14.99 per year. Adds unlimited wallets and budgets, and enables shared wallets. Still requires manual entry.

Spendee Premium: Around $5.99 per month or $35.99 per year. Adds automatic bank sync and auto-categorization. All plans include a 7-day free trial.

Prices may vary slightly depending on your region or app store. Spendee typically displays prices in your local currency.

Pros:

Clean and friendly user interface that makes budgeting feel less intimidating

Seamless shared wallets with real-time sync and permission controls

Strong multi-currency and crypto support, great for travelers and international use

Affordable pricing, especially for manual budgeters using the Plus plan

Helpful automatic categorization for Premium users with connected bank accounts

Cons:

Bank syncing is locked behind the Premium plan

Lacks advanced financial tools like investment tracking or debt planning

Web app lacks full feature parity with mobile apps as of mid-2025

Free plan has significant limitations, including just one wallet and one budget

Customer support may be slower than larger competitors and updates are less frequent

Platforms:

Spendee is available on iOS and Android. It also offers a web app for desktop access via browser. While mobile apps are the most complete, the web interface is gradually improving. Data syncs through the cloud so changes are reflected across all devices. There is no offline desktop application and internet access is required for syncing and usage on the web.

AI and Extensibility:

AI features: Spendee does not use AI assistants or predictive insights. Categorization is rule-based and may include light automation but is not powered by AI recommendations.

Extensibility: Spendee does not offer an API or plugin system. You can export data but not connect the app to external platforms or build custom modules. Spendee aims to provide a complete experience out-of-the-box.

5. PocketGuard

Overview:

PocketGuard is a cash flow-focused budgeting app designed to simplify money management. Its main strength lies in helping you understand how much money you have available to spend right now. Instead of deep budget planning, it gives you a clear “In My Pocket” balance by automatically tracking your income, bills and savings goals. The app connects to your financial accounts and updates your status in real time. PocketGuard also identifies recurring subscriptions and suggests ways to reduce expenses. It’s ideal for people who want to avoid overspending without diving into complex budgeting structures.

Key Features:

Automatic Account Sync:

PocketGuard connects securely to over 30,000 banks and financial institutions, mostly in the US and Canada. It pulls in your transactions and updates your balances automatically using aggregators like Plaid. Most users never need to enter data manually.

“In My Pocket” Balance:

The app’s standout feature is a real-time balance showing how much money you can safely spend. After accounting for bills, savings and planned expenses, PocketGuard displays a leftover number that helps you make everyday decisions. It answers the question “Can I afford this?” in a glance.

Subscription and Bill Tracking:

PocketGuard scans your transactions to identify recurring subscriptions and bills. It builds a list of these, alerts you to upcoming payments and even suggests options for cancelling or negotiating them. While it doesn’t cancel anything for you, it provides helpful links and tips to save money.

Goals and Debt Payoff (Plus):

PocketGuard Plus adds savings goals and debt payoff tools. You can create custom goals or enter debt balances, and the app will allocate funds from your leftover balance toward them. It supports popular payoff strategies like snowball and avalanche methods.

Spending Insights and Custom Categories:

The app auto-categorizes expenses and provides simple monthly reports. You can set custom spending limits and receive alerts when you’re close to going over. Categories are editable in Plus. All data is encrypted and you can use biometric or PIN security for privacy.

Pricing:

PocketGuard offers a Free plan and a Premium upgrade called PocketGuard Plus.

Free Version: Includes core functionality like bank sync and the “In My Pocket” balance. Limited to 2 bank accounts and 1 cash account. Custom categories, export and goals are not available.

PocketGuard Plus: Costs $12.99/month or $74.99/year. Includes unlimited accounts, full category customization, savings goals, debt payoff planning, data export and advanced insights. A 7-day free trial is available. Occasionally, a one-time lifetime license is offered in-app (e.g. $79.99), which may be a good value for long-term users.

Pros:

Fully automated tracking with real-time updates

Simple, actionable “leftover” balance to guide daily spending

Helps uncover savings by identifying recurring charges

Free version is functional for basic tracking

Plus includes solid financial planning tools for goals and debt payoff

Cons:

Free version has strict limits on accounts and categories

Premium pricing is high compared to similar apps

International support is limited and lacks multi-currency features

Subscription cancellation must be done manually

Few advanced tools and little customization for power users

Platforms:

PocketGuard is available on iOS, Android and web. You can log in via desktop browser or use the mobile app, with both versions syncing seamlessly through the cloud. The web interface is suitable for managing goals or exporting data, while the mobile app is best for quick checks and daily tracking.

AI and Extensibility:

AI features: PocketGuard does not use AI assistants or predictive features. Its automation focuses on transaction syncing and simple cash flow calculations.

Extensibility: The app is a closed system. There is no API or plugin support. You can export data manually, but you cannot integrate PocketGuard directly with other personal finance tools.

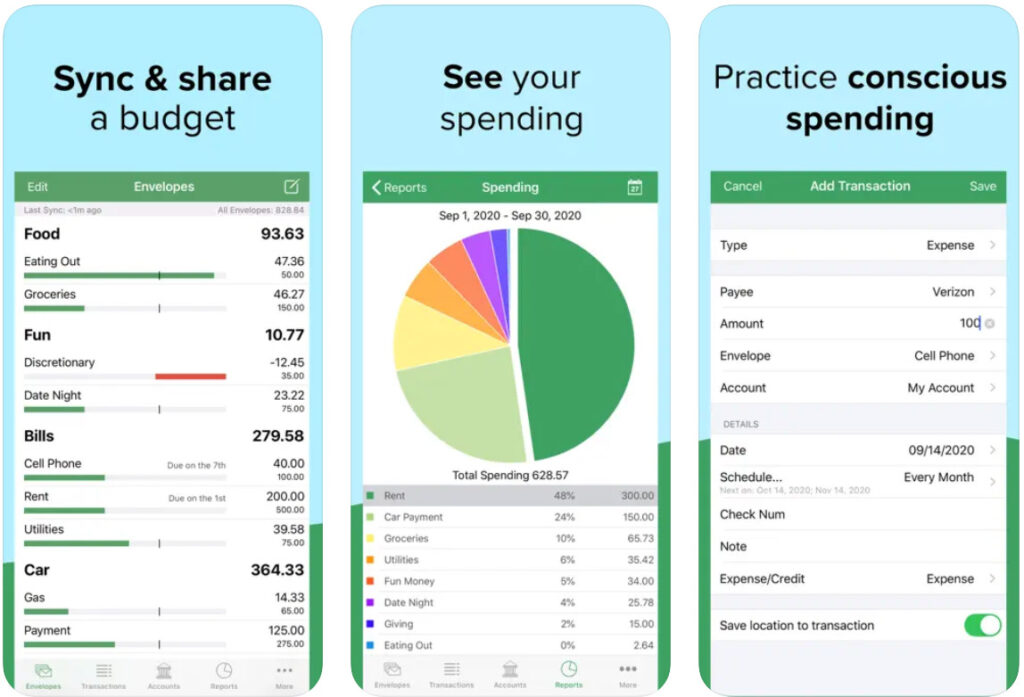

6. GoodBudget

Overview:

Goodbudget is a straightforward budgeting app based on the classic envelope method. It helps you assign your income to virtual envelopes that represent your spending categories, like groceries or rent. As you spend, you deduct from the respective envelope, making it easy to see how much you have left in each area. Goodbudget is especially useful for couples and families, with seamless multi-device sync that keeps everyone aligned. It’s not flashy or packed with extras, but it’s dependable and clear. The app encourages intentional spending and planning together with a partner or household.

Key Features:

Envelope-Based Budgeting:

You allocate funds into envelopes at the start of each budgeting cycle. Each envelope represents a spending category. As you log transactions, money is deducted from the appropriate envelope. This system makes it easy to prevent overspending and visualize remaining budgets. Money left over can be rolled forward or reassigned.

Sync and Share Across Devices:

You can share one Goodbudget account with multiple users. Budget changes sync across devices in real time. The free plan supports syncing on up to two devices, while Premium allows five. There’s also a web app, so one person can manage the budget on a desktop while another uses the mobile app.

Multi-Platform Support:

Goodbudget is available on the web, iOS and Android. The full-featured web app is ideal for setup and planning, while the mobile apps are great for quick entry and on-the-go checks. All platforms sync through the cloud.

Savings and Debt Envelopes:

Beyond monthly spending, you can create Goal envelopes for saving and Debt envelopes for paying off loans. Goodbudget tracks your progress over time and helps you stay disciplined by funding those goals with regular contributions.

Reports and Data Export:

The app provides clear visual reports like pie charts and bar graphs showing spending by envelope or income vs. expenses. For deeper analysis, you can export data to CSV and use tools like Excel or Google Sheets. You can also import bank transactions manually via file upload.

Pricing:

Goodbudget offers two plans:

Free Plan: Includes up to 20 envelopes (10 regular and 10 additional), one linked account and sync on two devices. Manual entry only, with one year of transaction history.

Premium Plan: Costs $10/month or $80/year (about $6.67/month billed annually). Premium allows unlimited envelopes and accounts, five devices, seven years of history and automatic bank syncing for US banks only. It also includes email support.

Pros:

Proven envelope method encourages thoughtful and disciplined budgeting

Designed with couples and families in mind, with smooth real-time syncing

Free plan is generous, includes multiple envelopes and devices with no ads

Web app adds power and flexibility for detailed planning

Focuses purely on budgeting, without distractions or data selling

Cons:

Manual entry required unless you have Premium and a US-based bank

No AI features, predictive tips or smart alerts

The envelope model may feel restrictive to users with irregular income

Automatic bank sync is US-only, with no multi-currency support

No integrations or plugin options for advanced users

Platforms:

Goodbudget works on any desktop browser, iOS and Android. The mobile apps focus on quick entry and balance checks. The web interface is more suited for planning, importing and reporting. There’s no desktop app, but the browser-based experience is strong and consistent across devices.

AI and Extensibility:

AI features: None. There’s no analysis, suggestions or smart categorization.

Extensibility: Goodbudget is a closed system with no API or plugin support. You can export and import files manually, but not connect to other services.

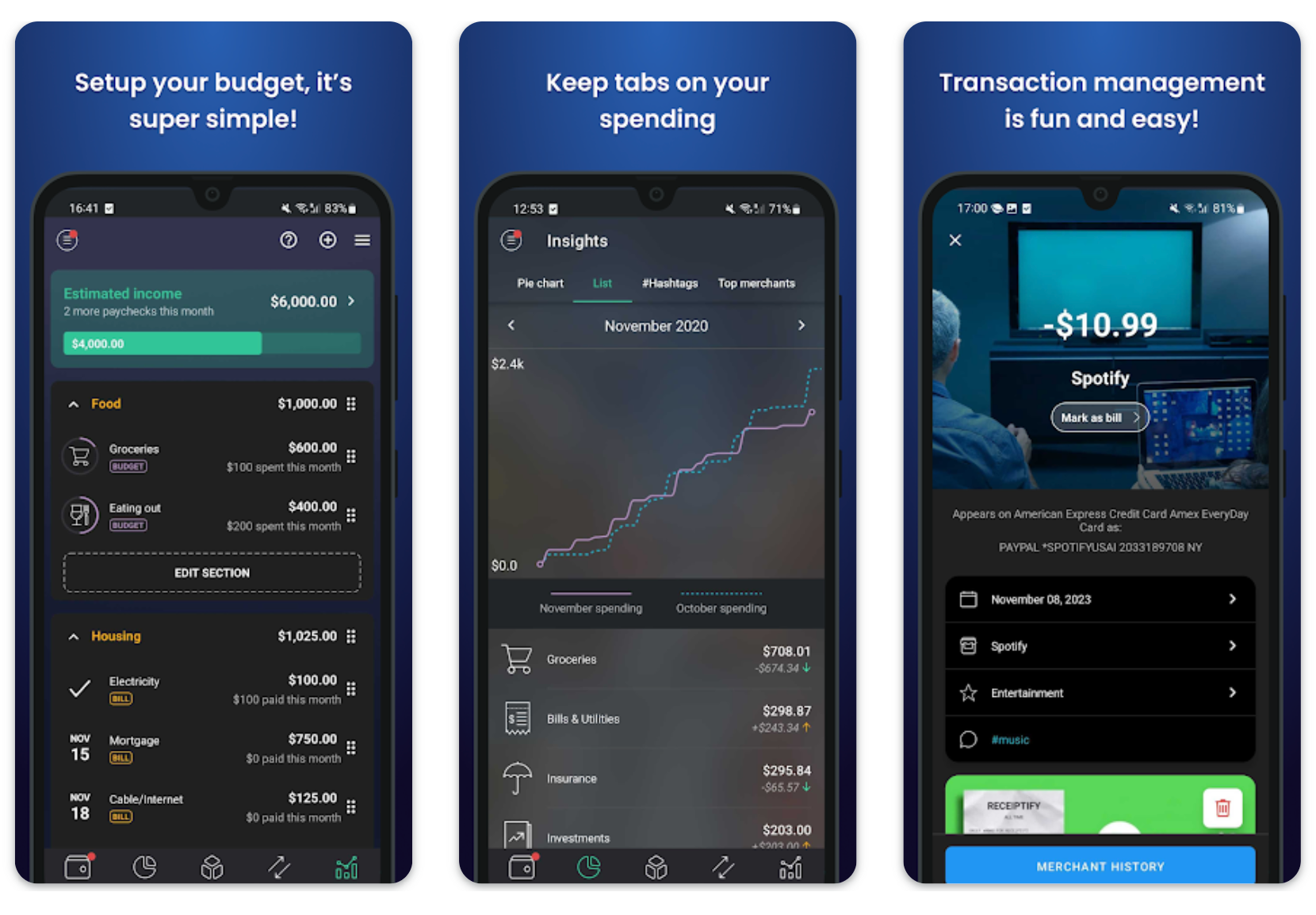

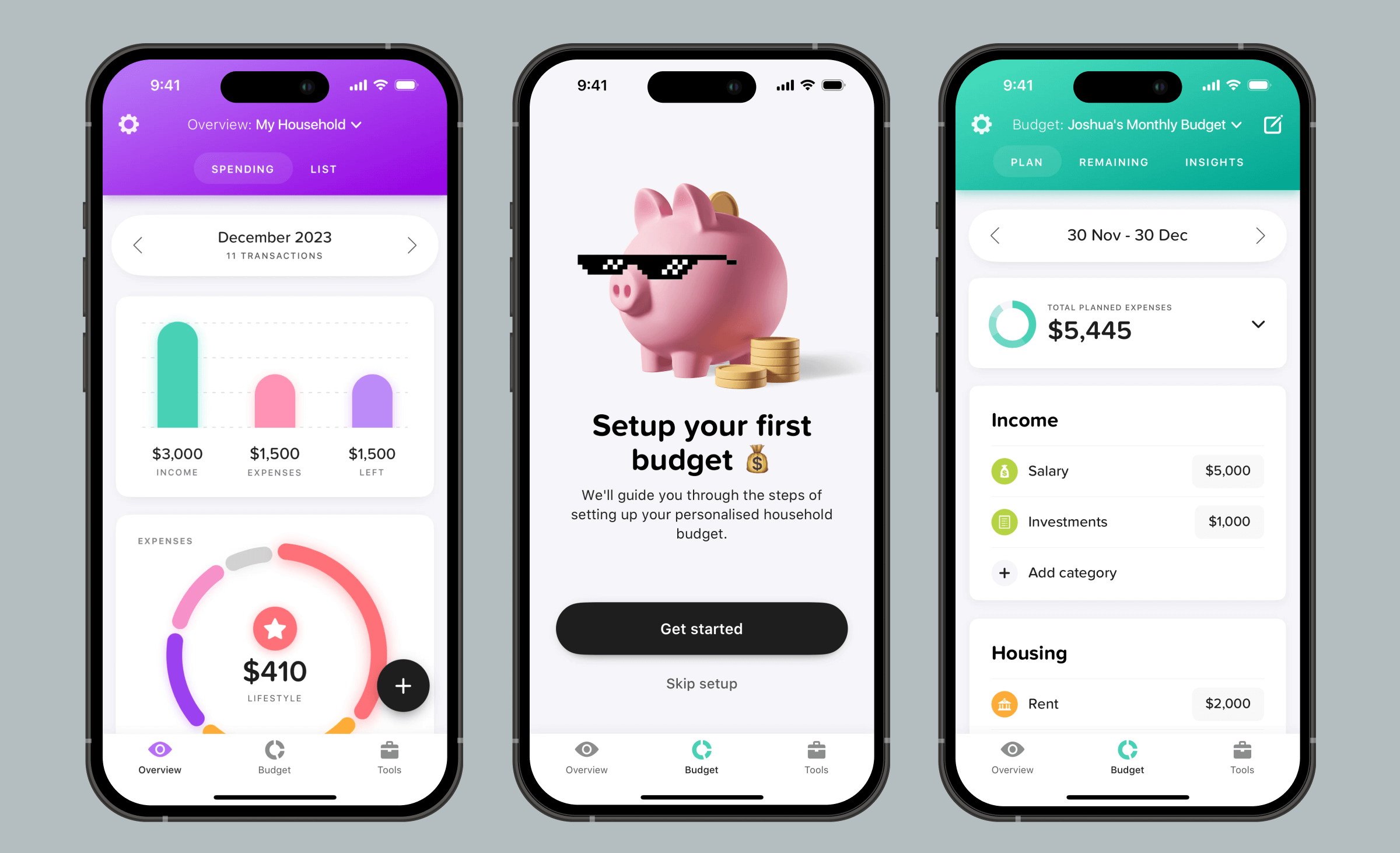

7. Buddy

Overview:

Buddy is a modern budgeting app designed to make money management feel simple, social and enjoyable. Built in Sweden and now used around the world, it’s particularly popular with younger users thanks to its vibrant design and easy onboarding. Buddy helps you create budgets quickly, track expenses and collaborate with others in real time. Whether budgeting solo or as a group, it focuses on clarity, transparency and visual appeal. It also supports multiple currencies and includes tools for managing subscriptions and recurring bills.

Key Features:

Fast and Friendly Budget Setup:

Buddy asks a few simple questions when you sign up, then generates a starting budget you can personalize. The process is quick and unintimidating. Many users report setting up a working budget in just a few minutes.

Shared Budgets in Real Time:

You can invite a partner, friend or roommate to join a shared budget. Everyone can add their transactions and view the overall budget at the same time. Buddy clearly shows who spent what and keeps all members aligned. This makes it ideal for couples or shared households managing joint finances.

Bank Sync and Subscription Tracking:

In supported regions, Buddy allows you to connect your bank accounts using open banking APIs. It automatically imports and categorizes transactions. The app also detects subscriptions and gives tips or links for cancelling them. In some cases, it offers suggestions for lowering bills by recommending better deals.

Custom Categories and Personalization:

You can fully customize your categories, budget limits and even the app’s appearance. Buddy offers a variety of color themes and uses animations and visuals to make budgeting feel less like work. This personalization makes the app more enjoyable and easier to stick with over time.

Multiple Accounts and Net Worth Tracking:

You can link multiple financial accounts, including checking, credit cards, savings and debt. Transactions can be assigned to specific accounts. Buddy displays your total balances and net worth, providing a high-level view of your financial situation. It does not focus on investments, but it covers everyday money management well.

Pricing:

Buddy has a free version and a Premium plan.

Free Version: Lets you create and manage budgets manually. Some features like bank sync, subscription tracking and shared budgets are limited or unavailable.

Buddy Premium: Costs around $4.99/month or $34.99/year. Unlocks unlimited budgets and accounts, bank sync, collaborative budgeting, subscription detection and advanced customization. A free trial is usually available.

Prices may vary slightly by region, and Buddy typically charges in your local currency.

Pros:

Beautiful, friendly design praised by Apple and featured on the App Store

Excellent for budgeting with others, with real-time updates and clear expense breakdowns

Easy onboarding makes it beginner-friendly

Supports multiple currencies and works well across different countries

No ads, and a transparent pricing model with free trial options

Cons:

iOS-only as of 2025, with no Android or web access available

No advanced investment tracking or financial forecasting tools

Bank syncing may not be available for all countries or smaller banks

Lacks AI-driven insights or automation beyond basic trends

No extensibility or API for advanced users who want integrations

Platforms:

Buddy runs on iOS, including iPhone and iPad. There is no Android or web version currently. All data syncs through Buddy’s cloud backend, so your budget updates appear across all your Apple devices when logged in. The lack of cross-platform support is the app’s most significant limitation for now.

AI and Extensibility:

AI features: Buddy does not include AI-driven insights or a virtual assistant. It has rule-based features like recognizing subscriptions and recurring expenses, but not intelligent advice.

Extensibility: Buddy does not have an API or plugin system. It is a closed platform focused on simplicity and user experience.

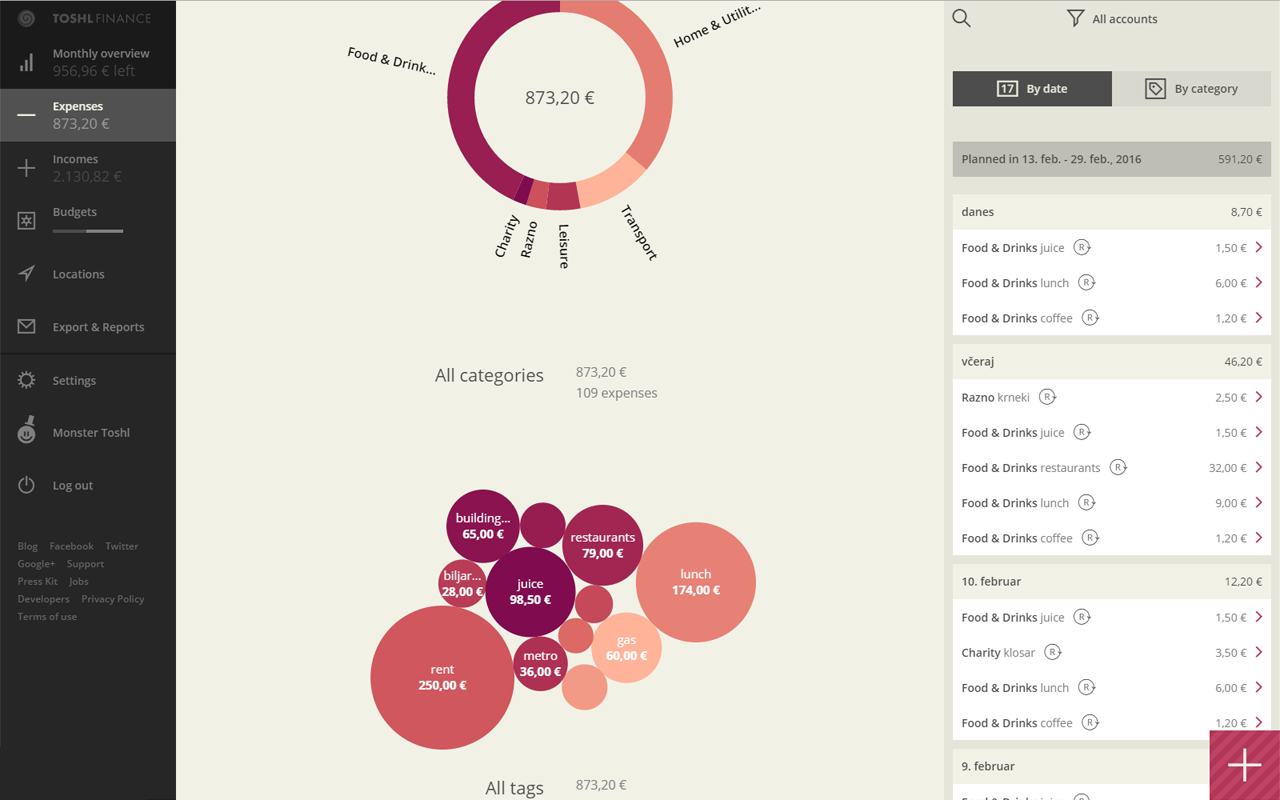

8. Toshl Finance

Overview:

Toshl Finance is a flexible, feature-rich budgeting app with a personality. Known for its quirky monster mascots and strong multi-currency support, it caters to globally minded users and advanced budgeters. Founded in 2011, Toshl has built a loyal user base by offering detailed tracking tools, powerful data export options and one of the most comprehensive currency systems in any budgeting app. Whether you’re dealing with multiple incomes, managing money across borders or just want full control of your data, Toshl adapts to your needs.

Key Features:

Multi-Currency Mastery:

Toshl supports nearly 200 currencies, including over 30 cryptocurrencies. Exchange rates update hourly. You can enter transactions in any currency and Toshl will convert and group them under your primary currency. This is ideal for international travelers, expats or anyone juggling currencies regularly.

Custom Budget Periods and Planning:

Unlike most apps that stick to monthly cycles, Toshl lets you define any budget period – weekly, bi-weekly, quarterly or custom ranges. You can budget by category or set total spending limits. A visual Planning graph shows your projected balances by combining future expenses, income and budgets.

Automatic Bank Sync (Medici Plan):

With the Medici subscription, Toshl connects to over 13,000 banks in 60+ countries. It imports transactions automatically and categorizes them. You can also build your own rules and tags for better sorting. Manual entry is always available too.

Tags, Notes and Photos:

Toshl allows multi-tagging, so you can track spending across overlapping contexts. For example, you can tag an expense as both “Vacation” and “Transport.” You can add notes, GPS data and attach up to 4 receipt photos per entry (with Pro or Medici). This makes Toshl a favorite among users who want detailed records.

Data Export and API Access:

Toshl puts data ownership front and center. You can export your full financial history in CSV, Excel, PDF, Google Sheets or even Evernote formats. Developers can use Toshl’s public API to access data programmatically or build custom dashboards. This makes Toshl one of the most extensible personal finance tools available.

Pricing:

Toshl offers three plans:

Free Plan: Track up to 2 accounts and 2 budgets. Includes full multi-currency support but lacks features like automatic syncing, repeating transactions and data attachments.

Toshl Pro: Around $2.99/month, $19.99/year or $59.99 for 3 years. Adds unlimited accounts and budgets, repeating transactions, graphs, reminders, fingerprint lock and receipt uploads.

Toshl Medici: Around $4.99/month or $39.99/year. Includes all Pro features plus automatic bank syncing across all connected accounts. All paid plans include a 30-day free trial.

Pricing is shown in your local currency when available, and discounts are sometimes offered.

Pros:

Exceptional multi-currency support, including crypto

Custom time periods and detailed future balance planning

Powerful export options and public API for developers

Flexible tagging, notes and attachments for data-rich tracking

Friendly UI with playful elements that make budgeting feel less dry

Cons:

Free plan is limited and more of a trial than a full solution

May feel complex or overwhelming for beginners

Bank sync requires Medici plan – no free syncing

Lacks built-in investment tracking or long-term net worth charts

No AI insights or smart budgeting recommendations built in

Platforms:

Toshl is available on iOS, Android and Web. The web app is especially useful for reports, exports and planning. Mobile apps work offline and sync when connected again. Toshl supports multiple languages and provides a consistent experience across all platforms.

AI and Extensibility:

AI features: Toshl does not use AI or virtual assistants. All analysis is manual.

Extensibility: Offers one of the best APIs in the budgeting space. Tech-savvy users can create custom tools, dashboards or even bots to interact with their data.

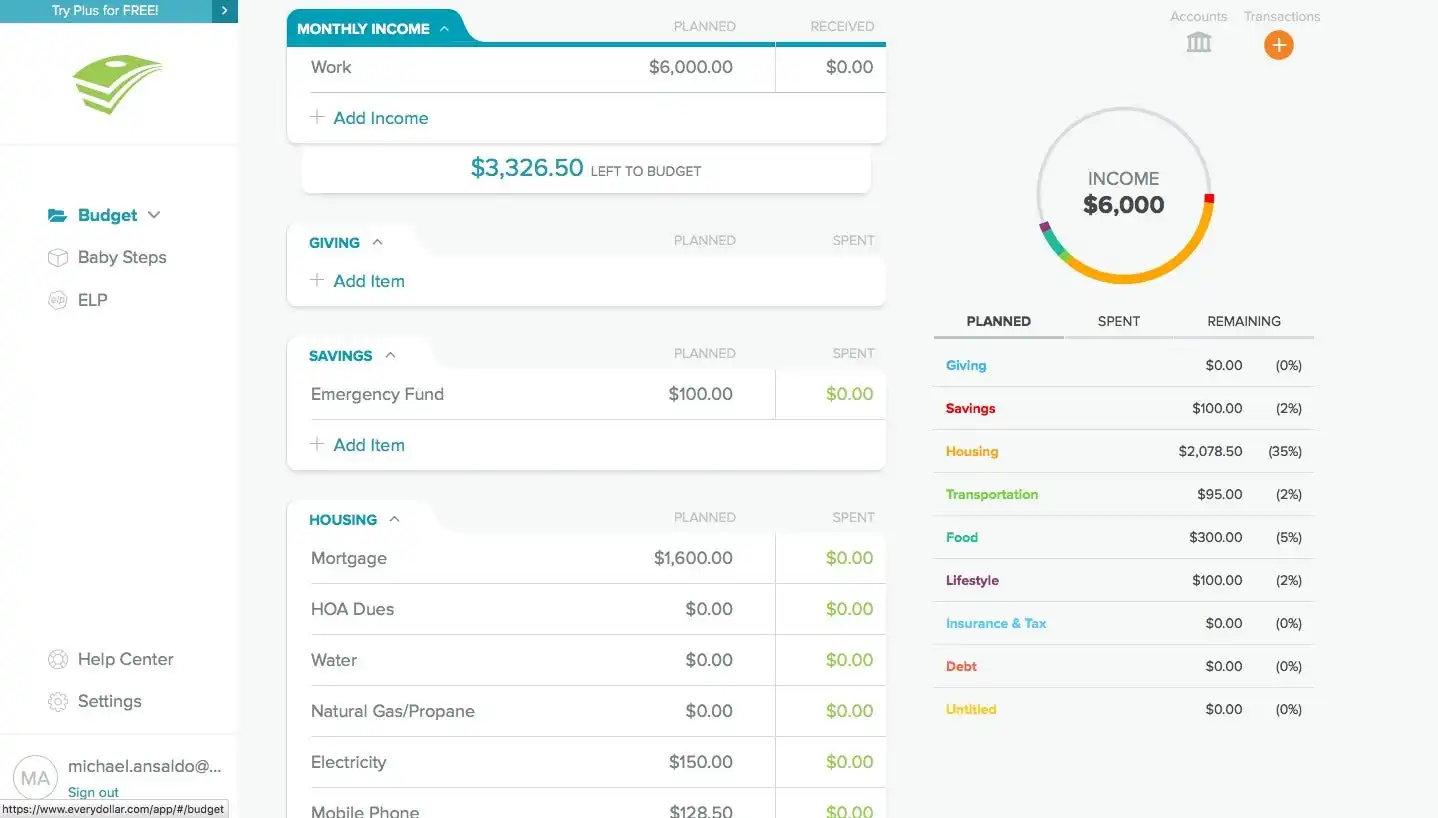

9. EveryDollar

Overview:

EveryDollar is a simple, no-nonsense budgeting app built around the zero-based budgeting method popularized by Dave Ramsey. The idea is to assign every dollar of income a specific job, so that income minus expenses equals zero. The app is designed to reinforce disciplined spending and aligns closely with Ramsey’s Baby Steps program. It’s especially popular among users who follow Ramsey’s financial philosophy, but even without that background, EveryDollar offers a clean and effective way to take control of your cash flow.

Key Features:

Zero-Based Budgeting Made Simple:

EveryDollar helps you assign all of your income to specific categories or savings goals. The app guides you through creating a budget each month, encouraging you to actively allocate funds to each category until nothing is left unassigned. You can customize categories and track progress as the month unfolds.

Fast, Clear Interface:

The interface is intuitive and uncluttered. Many users report completing their first budget in under ten minutes. It feels like a digital version of the pen-and-paper worksheets Ramsey often promotes. There’s no financial jargon or unnecessary complexity, making it ideal for budgeting beginners.

Multi-Device Syncing:

EveryDollar works across web, iOS and Android, and all versions sync through your Ramsey account. You can share the same account with your spouse or partner so both of you can add expenses on the go. Any updates made from desktop or mobile are instantly reflected across all devices.

Savings Funds and Goal Tracking:

Within each category, you can create savings funds for future expenses like holidays or car maintenance. These roll over month to month so you can track long-term goals. EveryDollar also tracks your progress through Ramsey’s Baby Steps plan, if you choose to follow it.

Ramsey+ Integration (Premium):

Premium users get access to Ramsey+ content, including Financial Peace University videos and live Q&A sessions with financial coaches. The Premium plan also includes automatic bank sync, allowing transactions to flow in directly from your accounts for easier tracking.

Pricing:

EveryDollar has two versions:

Free Plan: Allows full manual budgeting with unlimited categories. You can enter transactions by hand, sync between devices and access both web and mobile versions.

Premium Plan: Costs around $17.99/month or $79.99/year. Includes automatic transaction syncing, bank account balance tracking, enhanced reporting and access to Ramsey+ learning materials. A 14-day free trial is available for new users.

Pros:

Very easy to set up and understand, even for first-time budgeters

No ads or distractions – it’s purely focused on budgeting

Strong alignment with Dave Ramsey’s personal finance method

Great for couples budgeting together with shared device syncing

Free plan works indefinitely for users who don’t mind entering data manually

Cons:

Automatic syncing and reports are only available on Premium

Premium pricing may feel steep, especially outside the US where bank sync might not work

No investment tracking, net worth calculations or advanced planning tools

App structure reflects Ramsey’s philosophy, which may not suit every lifestyle

No multi-currency support or custom period budgeting – designed for monthly, US-based budgets only

Platforms:

EveryDollar is available on the web, iOS and Android. The mobile apps are ideal for entering transactions quickly, while the web version works well for setup and review. There is no desktop software, but the browser-based web app functions well for larger screens. All platforms sync seamlessly.

AI and Extensibility:

AI features: EveryDollar does not use AI to analyze or offer spending insights. All decisions and adjustments are manual.

Extensibility: The app does not support third-party integrations or offer an API. You can export data in CSV format, but that’s the limit of data portability.

10. Copilot Money

Overview:

Copilot is a premium personal finance app built exclusively for Apple users. It combines a clean, modern design with powerful automation and machine learning to deliver a seamless budgeting experience. With a focus on cash flow clarity and category-based budgeting, Copilot helps users stay on top of spending while offering smart suggestions based on past behavior. It’s especially popular with users who value automation, privacy and a native Apple experience.

Key Features:

Native iOS, iPadOS and macOS Support:

Copilot is designed specifically for Apple platforms and supports all the latest system features like Face ID, system-wide dark mode, widgets, and iCloud syncing. The app feels fast and fluid across iPhone, iPad and Mac.

Automatic Bank Sync and Cash Flow Tracking:

Copilot connects to U.S.-based banks and credit cards through secure APIs. It pulls in transactions and calculates your real-time available cash after accounting for bills and recurring expenses. You get a daily snapshot of what’s safe to spend.

Smart Categorization with Copilot Intelligence:

The app uses machine learning to automatically categorize your transactions. Over time, it learns your habits and improves its accuracy. You can create custom rules to tailor the experience and fine-tune your budget.

Visual Budgets and Rollovers:

Copilot offers colorful and emoji-enhanced budget categories. You can set monthly spending targets, allow unused amounts to roll over, and quickly edit past entries with batch tools. The app provides visual cues to show if you're ahead or behind your targets.

Subscription Tracking and Bill Forecasting:

Recurring subscriptions are automatically detected and grouped for review. Copilot highlights upcoming charges and tracks bill patterns, giving you advance notice of recurring expenses and spikes in spending.

Privacy and Transparency:

Copilot never shows ads, sells your data or markets financial products. It’s a subscription-based app with a clear, privacy-respecting model.

Pricing:

Copilot offers a 60-day free trial. After that, it costs $13/month or $95/year (around $7.92/month billed annually). All features are included in one plan. Pricing is shown in local currency when applicable.

Pros:

Built natively for Apple devices with a polished, modern interface

Excellent automatic transaction import and smart categorization

Real-time net cash flow tracking helps prevent overspending

Privacy-focused with no ads or third-party data use

Ideal for users who prefer visual clarity and smooth UX

Cons:

Only available in the U.S. with U.S. bank support

No web or Android version, which limits access for non-Apple users

Lacks advanced budgeting features like payee rules or deep forecasting

No investment tracking, debt payoff planning or AI-based financial advice

Higher annual price than some competitors with broader platform support

Platforms:

Copilot runs on iPhone, iPad and Mac. There is no web app or Android version. Data syncs seamlessly through iCloud between Apple devices. The app is optimized for both mobile and desktop use on Apple hardware.

AI and Extensibility:

AI features: Machine learning is used for transaction categorization and budget adjustment. However, it does not offer conversational AI or proactive spending advice.

Extensibility: Copilot is a closed system with no public API or plugin support. Data exports are limited and mostly used for backups.

Ready to take control of your finances?

Start tracking expenses, managing budgets, and planning your financial future with Rewiser.